Wall Street Is Wrong About Biotech

Markets are down and IPOs are ice-cold but cell therapies, AI-designed capsids, and 250 active editing trials are sprinting ahead.

Biotech is having a really rough time right now.

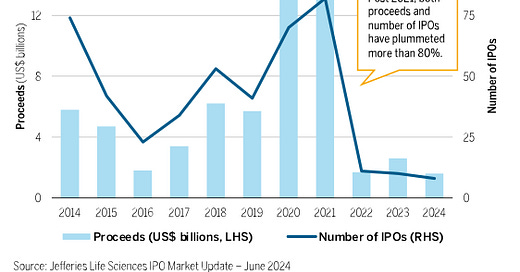

The SPDR S&P Biotech ETF (XBI) is still 45% below its 2021 peak.

Investors have become conservative. The capital markets suck and IPO windows are effectively shut.

And it’s especially bad for longevity startups.

The 2024 IPO class has produced average returns of negative 52%. Most recent public biotechs are trading 70% below their offer price.

Small-molecule "asset plays" are back in vogue, marking another swing of the asset <-> platform pendulum.

Yet even these single-asset stories are struggling to close their Series-Bs.

And the big pharma companies are too occupied with geopolitical uncertainty and saving their own pipelines to save the promising startups that VCs are being forced to abandon.

Skepticism around gene editing, delivery, efficacy, safety, has resurfaced.

Yet the evidence tells a different story:

- 43 FDA-approved gene/cell therapies are already on the market, up from 8 just five years ago.

- CASGEVY became the first CRISPR-edited therapy to win FDA approval in late 2023... and is now reimbursed the US, UK and Bahrain.

- 250 gene-editing trials are active worldwide today, spanning oncology, metabolic, and rare disease.

The delivery tech stack is also compounding quietly.

- Organ-targeted LNPs now hit 40–60% editing in mouse heart/lung. 10x better than 2021 benchmarks.

- Engineered capsids, polymers, and exosomes have cut off-target liver uptake 2–3x in primates.

We’ve seen this movie. Remember when RNAi was “dead money”? Behind the scenes, the data looked good. Incremental progress was being made.

But in the capital markets of the time, sentiment trumped data.

Today, six siRNA drugs are on the market. They generate >$3B in annual sales.

The march of human (and AI-driven) progress in biology has not stopped.

- ML-guided capsid engineering has halved lead-to-candidate time in several pharma programs.

- GUIDE-seq-detectable off-target sites have dropped ~10-100x since 2015, i.e. ≈2× fidelity gain every 18–24 months.

Sounds to me a lot like the Moore’s law for engineering biology.

Capital is cyclical, but the tech stack (high-fidelity editors + ML-accelerated delivery) is keeping course on its exponential trajectory.

Betting against that curve was wrong for RNAi. It’s likely wrong for cell therapy and genome engineering today.

Do not ignore the data.

Over the next decade, these tools will open an uncharted frontier of therapeutics development.

To what degree is the biotech ETF likely to be correlated with these advancements (as opposed to them mostly happening in private companies whose value will be priced in long before going public or being added to any index)?